Kupiec And Christoffersen Test

Backtesting is a framework that uses historical data to validate financial models, including trading strategies and risk management models. Depending on the goals of validation, financial professional use more than one indicator or methodology to measure the effectiveness of financial models.Backtesting is routinely performed in trading and risk management. As a result, there are a number of dedicated backtesting techniques specific to these two areas.In trading, common backtesting techniques include:. In-sample vs. Out-of-sample testing. Walk-forward analysis or walk-forward optimization.

Kupiec And Christoffersen Test Center

Instrument-level analysis vs. Portfolio-level assessmentIn risk management, backtesting is generally applied to (VaR) and is also known as VaR backtesting. Golden baby forgotten world download. There are various VaR backtesting techniques, such as:. Basel's traffic light test.

Kupiec And Christoffersen Test Strips

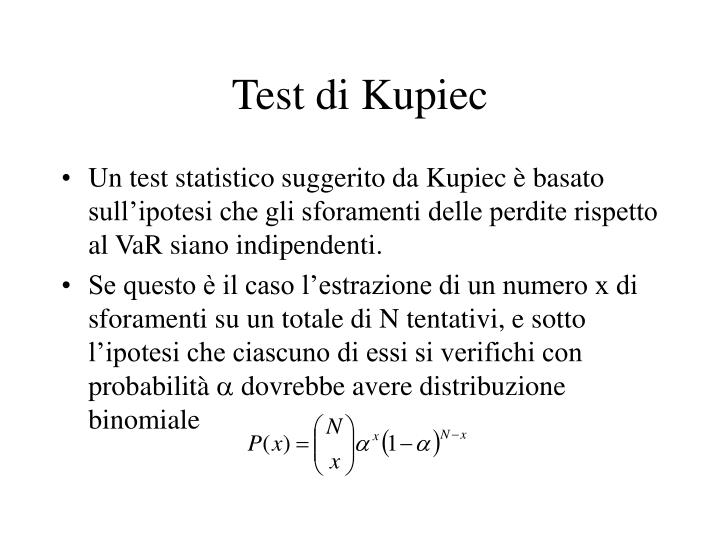

Binomial test. Kupiec's proportion of failures test. Kupiec's time until first failure test. Christoffersen's conditional coverage mixed test. Christoffersen's conditional coverage independence test. Haas' time between failures or mixed Kupiec test. Haas' time between failures independence testFor more on backtesting, see,.